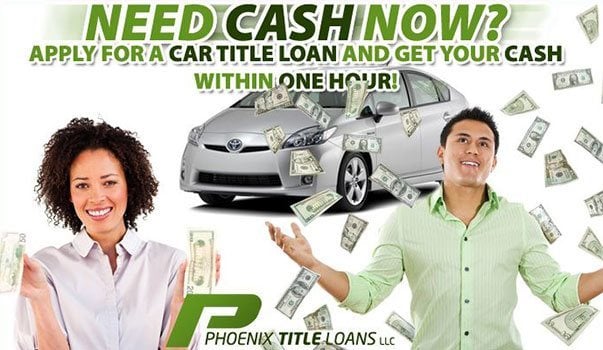

Borrow Money Easy, Borrow Money Fast, Auto Title Loans!

Borrow Money Fast When You Need To

There are moments in life where time is of the essence. This is most apparent when you need to borrow money, and quickly. When it is imperative to have a means of income in order to pay expenses, such as hospital bills, towing and impound expenses, or even pay your electric bill, the last thing you want to do is wait. That’s when auto title loans can be the most beneficial to you. Because you can borrow money easy and quickly, and even keep driving your vehicle while you pay off the loan. Let us explain.

expenses, such as hospital bills, towing and impound expenses, or even pay your electric bill, the last thing you want to do is wait. That’s when auto title loans can be the most beneficial to you. Because you can borrow money easy and quickly, and even keep driving your vehicle while you pay off the loan. Let us explain.

Borrow Money Made Quick & Easy? Sounds Too Good To Be True…

The skepticism is what we expect. Any other case and we would agree, but we’re confident in the ease of receiving money from one of our title loan programs. It could be as quick and painless as a drive down to the closest location; and 45 minutes later, you got cash! Now that’s quick. But to be fair, the process can take up to an hour from application to cash payout, depending on the circumstances.

Also, with multiple locations, you don’t have to travel to the ends of the Valley just to borrow money for an expense. That’s not all. Complete and submit our online application to get the process started, before you even head to our closest location to you. You will receive a response, with an estimated amount that we can loan, based on the application, in your email’s inbox within 20 minutes or less.

Our live-chat assistant will let you know where to find the nearest location to borrow money, and what you need to have with you to complete the paperwork. Once you arrive, mention your online app, and our associate will pull it up, and start right where you left off.

What Are The Advantages Of Auto Title Loans When I Borrow Money?

Well, auto title loans help you borrow money, based on the loan-to-value, to secure the loan. There’s no drawn out method of inspection, and credit checks are not required. Whether you have Good Credit, Bad Credit or No Credit and we can be the lender that helps you with the cash you need.

have Good Credit, Bad Credit or No Credit and we can be the lender that helps you with the cash you need.

Simply come to any of our locations nearest you with your car and title, show us your drivers license (or Arizona State ID equivalent…but we will question how you GOT here). What it boils down to is that now you have other means to get the money you need. That method is entirely on the value of the vehicle itself, so you don’t have to worry about your credit score or work/pay stub (though the latter helps; not a deal-breaker). We just assess the condition of your vehicle, based on make, model, year, and its condition.

We’re also not picky on vehicle brands either. We’re willing to make title loans for all: Ford, Chevy, Toyota, Isuzu, even RAM. Be it a car, truck, van, SUV, ATV, motorcycle, or even a Restored Salvage vehicle, we’ll offer you a title loan to borrow money when you need it. It never hurts to come to the store and ask about it.

How Much Will My Monthly Payment Be?

Since it is a loan, of course you’ll need to pay back the amount you borrowed, plus the monthly interest that accrues, for the duration of the loan. We pride ourselves in being able to provide low interest cash loans to our customers Particularly when the loan you’re looking for is only short term, we can provide you the fast cash you need in as little as an hour while still being able to get you a pay off quote that keeps the interest at a minimum.

You can choose to have your monthly payment only cover your monthly interest. In the end, agreeing to pay off the amount of the principal at the end of the loan. Or we can have your monthly payment include some of the principal, according to what you can afford. Thereby, chipping away at the principal as you keep up on the monthly interest. And ultimately, with each payment, your accrued monthly interest decreases, and more of your payments will eventually go towards the principal.

In addition, we can create a refinance a plan for your current situation. Fortunately, we have means of making it possible for our customers to do so, and methods to take on this challenge. But it does require that you reach out to us, and let us know what your circumstances are, for us to be work out a payment agreement.

Ask about our Preferred Title Loans / Preferred Pawn Loans program. Because if you qualify, you can increase your cash offer, lower your monthly interest rates, or perhaps both, when you borrow money from Phoenix Title Loans!

Why Come to Phoenix Title Loans for This?

There are many reasons that we can state about us being the best choice to borrow money from. Our tenure for over a decade is the primary factor. We’ve aided many of the Valley’s residents from our 2 Phoenix locations, 3 in Mesa, and locations in Chandler, Tempe, Avondale, Scottsdale to Casa Grande. That speaks a lot of our business practices and prowess. Plus there also the fact that we’re Valley locals too. We know what it’s like to make a living, so we make our living offer assistance in the form of title loans.

from our 2 Phoenix locations, 3 in Mesa, and locations in Chandler, Tempe, Avondale, Scottsdale to Casa Grande. That speaks a lot of our business practices and prowess. Plus there also the fact that we’re Valley locals too. We know what it’s like to make a living, so we make our living offer assistance in the form of title loans.

Phoenix Title Loans also offers resources that every other auto title loan lender is afraid to offer. We’ve worked with people from every walks of life, no matter their income type, employment type, or whatever situation that life may throw at us. We believe in the borrowing power of auto title loans and don’t want to hinder individuals if they find themselves facing financial disparity. No matter what city in the Greater Phoenix area you’re in, we’re committed and devoted to getting our clients the cash they need when they need it.

Finally, there’s the reasons that aren’t on us, but on the customers themselves. For some, they exhausted first options. Others, either can’t afford the fees to GET the money (yes, those programs do exist) or their credit score is not optimal for the money they need. But no matter the situation, no matter the distance, we at Phoenix Title Loans are here to make our customers’ lives as manageable as we possibly can. Complete and submit our Quick Title Loans Application below, or just click on the bottom right of our screen, and take advantage of our live-chat assistant, for you to have cash in your hands as quickly as possible!

If you need to borrow money and exhausted all your resources, just know that Phoenix Title Loans will always have your back. We also have other options for our customers not interested in an auto title loan to get them cash, and with eleven valley wide locations, we can get you the cash you need no matter what.

DISCLOSURE: Loan amounts, terms, and rates vary by applicant and are subject to final approval. Not all applicants will qualify for the maximum advertised amount. All loans are secured by the value of your vehicle, which must be titled in Arizona and owned free and clear, unless otherwise stated.

Representative Example: A $2,000 auto title loan with a term of 12 months and an annual percentage rate (APR) of 35.99% would require 12 monthly payments of $200.96, for a total repayment of $2,411.52. All applicable fees and finance charges are included in the disclosed APR. This representative example is typical of a preferred loan with 25% Loan-to-Value ratio, $5,000 loan amount minimum, and a credit score of 700 or higher. Actual loan terms may vary based on vehicle value, requested loan amount, repayment ability, and applicable state regulations. CREDIT CHECK NOT REQUIRED ON MOST LOANS.

Early repayment is allowed at any time without penalty. Paying off your loan early may reduce the total cost of borrowing. Borrowers may be eligible for interest reductions when loans are paid off within an early payoff window, where applicable. We do not require a credit check for most auto title loans; however, all applicants must demonstrate the ability to repay the loan. Proof of income may be requested for underwriting purposes but is not always required for approval.

Approval times may vary and are subject to identity verification, vehicle inspection, confirmation of clear title status, and review of all required documents. While many loans are funded on the same day, some may require additional time for processing.

Phoenix Title Loans, LLC complies with all applicable federal and state lending regulations, including but not limited to the Arizona Revised Statutes Title 6, Chapter 5 and Title 44, Chapter 2.1, the Truth in Lending Act (TILA), and the Equal Credit Opportunity Act (ECOA). We are committed to transparency, fairness, and the responsible servicing of every loan. For borrowers who prefer to communicate in a language other than English, translated disclosures may be available upon request.