Tempe is an interesting part of the Valley

Snuggled between Phoenix, Scottsdale, Mesa, and Chandler is the ever bustling town of Tempe. Here, there are multiple parks, businesses, and the former HQ of US Airways prior to the American Airlines Merger of December 9th 2013. It is inspired by the Vale of Tempe in that it acts as a more suitable location for commuting and commerce in general. The city became a sort of hot spot for new businesses to take form during this critical place of commerce. There are other other beneficial factors to the rise of this town as well. Fresh new talent thanks to a local state university, and a healthy transit system have seen new life in the town. Phoenix Title Loans is one such business that benefited, as such we wish to give back to the city with our Title Loans!

Any Other Facts?

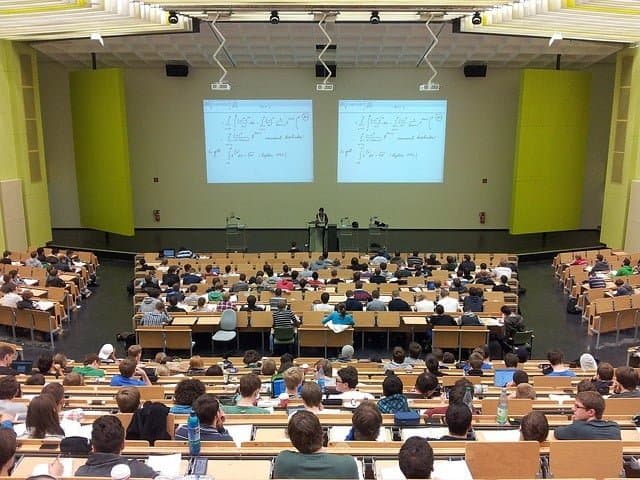

What many people actually don’t know about Tempe is that Arizona State University has actually taken the spot as the largest university in all of the United States. This is an incredibly unique award bringing booming businesses and construction to Tempe; making it a haven for not just students but big businesses alike. We’re proud to be one of the longstanding businesses inhabiting Tempe; being able to bear witness to another huge expansion of Tempe.

Our Tempe title loan services have been representing the great City of Tempe for over a decade. Home to tens of thousands of students trying to support themselves and pay their way through school, and we’ve been helping students graduate for over a decade. We have dozens of different services to ensure that anyone can get the cash that they need. We’ve all been in similar situations, we understand the struggles that life will throw at us, and we want nothing more than to help through it.

How Does This Apply to My Situation?

With a service that fits each and every person’s needs, despite any kind of extenuating circumstances, to ensure that in times of financial need we can save you. With the lowest interest rates, the lowest monthly payments, and the most cash Tempe title loans, Phoenix Title Loans is the only choice when you need fast cash.

We service title loans to Tempe, Arizona in the following zip codes:

About Tempe, Arizona

If Phoenix is the Heart of our Valley, then Tempe could be considered the Lungs; breathing new life into our Valley thanks to the brilliant and talented young individuals that grace Arizona State University. This also allows for local Downtown businesses to thrive as young adults and college students find their favorite ‘spot.’

The city gets additional recognition as having a major transit center along College Avenue. Here you have the freedom to choose riding on the Light Rail or taking a bus. The choice is yours to where you need to go. This freedom of choice makes travel easier for those commuting into the city for work. If they live out in, say, Mesa, they have the option of both as well.

DISCLOSURE: Loan amounts, terms, and rates vary by applicant and are subject to final approval. Not all applicants will qualify for the maximum advertised amount. All loans are secured by the value of your vehicle, which must be titled in Arizona and owned free and clear, unless otherwise stated.

Representative Example: A $2,000 auto title loan with a term of 12 months and an annual percentage rate (APR) of 35.99% would require 12 monthly payments of $200.96, for a total repayment of $2,411.52. All applicable fees and finance charges are included in the disclosed APR. This representative example is typical of a preferred loan with 25% Loan-to-Value ratio, $5,000 loan amount minimum, and a credit score of 700 or higher. Actual loan terms may vary based on vehicle value, requested loan amount, repayment ability, and applicable state regulations. CREDIT CHECK NOT REQUIRED ON MOST LOANS.

Early repayment is allowed at any time without penalty. Paying off your loan early may reduce the total cost of borrowing. Borrowers may be eligible for interest reductions when loans are paid off within an early payoff window, where applicable. We do not require a credit check for most auto title loans; however, all applicants must demonstrate the ability to repay the loan. Proof of income may be requested for underwriting purposes but is not always required for approval.

Approval times may vary and are subject to identity verification, vehicle inspection, confirmation of clear title status, and review of all required documents. While many loans are funded on the same day, some may require additional time for processing.

Phoenix Title Loans, LLC complies with all applicable federal and state lending regulations, including but not limited to the Arizona Revised Statutes Title 6, Chapter 5 and Title 44, Chapter 2.1, the Truth in Lending Act (TILA), and the Equal Credit Opportunity Act (ECOA). We are committed to transparency, fairness, and the responsible servicing of every loan. For borrowers who prefer to communicate in a language other than English, translated disclosures may be available upon request.