Auto Title Loans to Buy Car or Parts

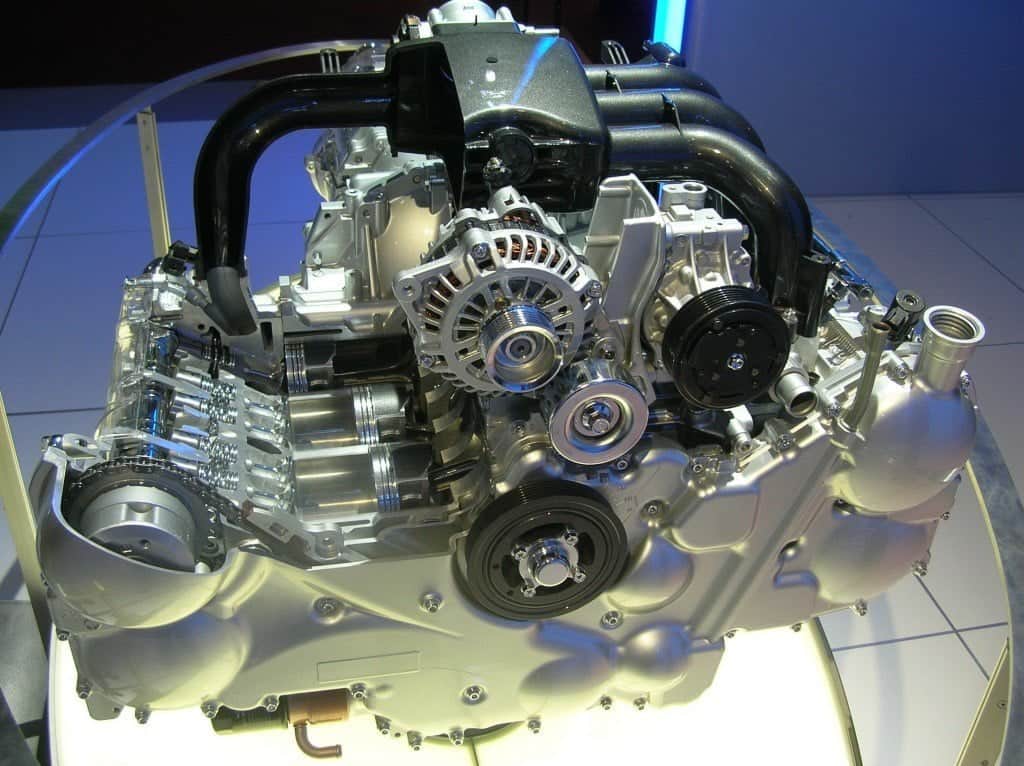

Fast Cash Auto Title Loans Can Finance Your New Car, and Car Part Purchases! When life comes knocking, sometimes you’re just not ready. Whether it’s just time to buy a new car and you need a down payment, or you don’t have the cash for that wicked expensive car parts to get you back on the road, Phoenix Title Loans, LLC, can get you the full, fast cash you need. Offering auto title loans on your existing car in Phoenix, Tempe, Mesa, Scottsdale, Casa Grande, and Chandler.

Auto Title Loans to Buy Car Parts? How does that work?

The process is very simple and very quick. While we do offer Car Repair Auto Title Loans, this type of auto title loan is vastly different. We are here to loan you the fast cash you need to simply purchase the necessary car parts you need. We have 11 valley wide locations to allow all of customers quick access to quick cash.

The process is very simple and very quick. While we do offer Car Repair Auto Title Loans, this type of auto title loan is vastly different. We are here to loan you the fast cash you need to simply purchase the necessary car parts you need. We have 11 valley wide locations to allow all of customers quick access to quick cash.

The easiest and quickest way that we suggest is simply to use our online application that you can find here and upload pictures of your vehicle. However, we still need to confirm the condition and state of the car, so do not forget you still must bring it in to one of our stores. You can also just give us a call at (480) 499-4699, or stop by in person if there are any issues with our process.

Don’t let a small sum of cash stop you from getting the car parts you desperately need. If you’re in Phoenix, Tempe, Mesa, Scottsdale, Chandler, or Casa Grande, you can get those car parts you need from Phoenix Title Loans, LLC, with an auto title loan

Make Your Down Payment on A New Car with our Auto Title Loan Too!

Usually an auto title loan is used when you’re in a spot of financial turmoil, and you truly need immediate, fast cash to solve these problems. What many people don’t think of is that you can use our auto title loan products to simply get the cash together to make a down payment on a brand new car.

Usually an auto title loan is used when you’re in a spot of financial turmoil, and you truly need immediate, fast cash to solve these problems. What many people don’t think of is that you can use our auto title loan products to simply get the cash together to make a down payment on a brand new car.

Trading in your old, used car is a scam, and you end up losing thousands and thousands of dollars that the dealership gets to profit from. Instead, you can get an auto title loan on your old car, get the thousands of dollars in cash you need for your down payment, and not have to lose any money whatsoever!

Don’t keep driving that old clunker around. If it’s time for a new car, it’s time for a new car, and Phoenix Title Loans, LLC, is here to do everything in our power to get you in those new set of wheels.

Why come to Phoenix Title Loans for these benefits?

Aside from availability Valley-wide at our ten locations, we also offer competitive loans that are regulated by the State of Arizona. This ensure you get the best deals under a fair practice. Finally, our professional staff will assist you with any concerns you have about the process at our store or by phone if you feel more comfortable that way. Our purpose is to provide Auto Title Loans to Buy Car replacements, parts, accessories, WHATEVER, and we’ll continue to provide this freedom to our customers! Stop by today and see for yourself the benefits Phoenix Title Loans has to offer.

Any other perks to Phoenix Title Loans that makes you stand out?

Absolutely! We also have the benefit of accepting almost ANY vehicle with clear title and a KBB Value over $2,500. If you don’t meet these guidelines, we can often suggest other alternatives.

We buy out title loans and even refinance title loans in case you feel it too much to handle. And at our location in Van Buren our Boat Title Loans customers have the benefit of us storing their boats with us while they pay. Free up time to get your loan paid and space around the home for whatever purpose in mind. What other Title Loan company is willing to provide these great services? Other than us, very few.

Multiple Locations in Arizona

One of the best features of Phoenix Title Loans is our multiple locations across the Valley of the Sun. Instead of desperately searching for an auto title loan Phoenix store, just look to us! We have eleven locations spread throughout the Valley, in Phoenix, Scottsdale, Chandler, Avondale, Mesa, Tempe, Casa Grande and so on. We even provided the kinds of auto title loans Casa Grande locals would want! And customers keep coming back to us as the auto title lender choice when they need a financial problem solved!

DISCLOSURE: Loan amounts, terms, and rates vary by applicant and are subject to final approval. Not all applicants will qualify for the maximum advertised amount. All loans are secured by the value of your vehicle, which must be titled in Arizona and owned free and clear, unless otherwise stated.

Representative Example: A $2,000 auto title loan with a term of 12 months and an annual percentage rate (APR) of 35.99% would require 12 monthly payments of $200.96, for a total repayment of $2,411.52. All applicable fees and finance charges are included in the disclosed APR. This representative example is typical of a preferred loan with 25% Loan-to-Value ratio, $5,000 loan amount minimum, and a credit score of 700 or higher. Actual loan terms may vary based on vehicle value, requested loan amount, repayment ability, and applicable state regulations.

Early repayment is allowed at any time without penalty. Paying off your loan early may reduce the total cost of borrowing. Borrowers may be eligible for interest reductions when loans are paid off within an early payoff window, where applicable. We do not require a credit check for most auto title loans; however, all applicants must demonstrate the ability to repay the loan. Proof of income may be requested for underwriting purposes but is not always required for approval.

Approval times may vary and are subject to identity verification, vehicle inspection, confirmation of clear title status, and review of all required documents. While many loans are funded on the same day, some may require additional time for processing.

Phoenix Title Loans, LLC complies with all applicable federal and state lending regulations, including but not limited to the Arizona Revised Statutes Title 6, Chapter 5 and Title 44, Chapter 2.1, the Truth in Lending Act (TILA), and the Equal Credit Opportunity Act (ECOA). We are committed to transparency, fairness, and the responsible servicing of every loan. For borrowers who prefer to communicate in a language other than English, translated disclosures may be available upon request.