Buy Out Title Loans in Mesa – Refinance Your Title Loan in Mesa, AZ

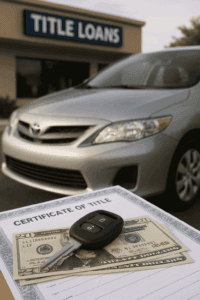

If you’re trapped in a high-interest car title loan and struggling to keep up with the payments, you’re not alone. Many Arizonans in this situation start looking for ways to buy out title loans in Mesa lenders have given them – essentially seeking a refinancing solution to escape unaffordable debt. Buy Out Title Loans in Mesa – these four words hold the key to your financial relief.

Phoenix Title Loans, LLC is here to help. We specialize in helping Mesa residents refinance or buy out title loans in Mesa customers are burdened with, replacing them with new, more manageable loans. Our goal is to save you money, lower your payments, and give you peace of mind while you keep driving your vehicle.

Phoenix Title Loans has over a decade of experience serving the Mesa community. We’re a licensed, reputable Arizona lender that operates within all state regulations, so you can trust that our buy out title loans in Mesa program is both legal and customer-focused. In fact, we’ve helped thousands of Mesa residents get out of bad title loans and into better ones.

This comprehensive guide will explain everything you need to know about title loan buyouts in Mesa – what they are, why they can benefit you, how the process works, and how to get started. Read on to learn how refinancing your title loan could be the key to regaining control of your finances – and how to buy out title loans in Mesa the right way with our help.

What is a Title Loan Buyout?

A title loan buyout is essentially a way to refinance your existing title loan with a new lender. In other words, another company (like Phoenix Title Loans) pays off your current loan in full and issues you a new loan, ideally with much better terms. This process is also known as title loan refinancing or title loan consolidation. When we buy out title loans Mesa customers have from other lenders, you still use your vehicle’s title as collateral and you keep your car – the difference is that now Phoenix Title Loans becomes the lienholder instead of your previous lender.

The goal of a buy out title loans Mesa service is to give you a fresh start on your debt. Instead of being stuck with a high-interest, high-payment loan that never seems to shrink, you can replace it with a more affordable loan. Think of it like trading in a bad loan for a better one. The new loan often comes with a lower interest rate, lower monthly payments, or a longer term to repay – making it much easier to manage.

It’s similar to how homeowners refinance a mortgage to get a lower rate. In fact, a title loan buyout is basically a refinance of your car title loan, just focused on helping Mesa drivers get out of predatory lending agreements and into a fair, comfortable payment plan.

In short, if you’re looking to escape a bad car title loan, it pays to buy out title loans in Mesa through a trusted lender and get a fresh start.

Why Refinance Your Title Loan in Mesa?

Refinancing or buying out your title loan can make a huge difference in your financial health. Here are some of the top reasons Mesa borrowers turn to Phoenix Title Loans for a title loan buyout:

Sky-High Interest Rates

Many title loans carry extremely high interest charges – often near the maximum allowed by Arizona law. For instance, Arizona permits monthly interest up to 17% on smaller title loans (source) — that’s over 200% APR! Other tiers still allow 10–15% per month on larger loans. If your current loan in Mesa is charging anywhere close to these rates, you’re likely paying a fortune in interest.

A buy out title loans in Mesa solution can get you a much lower rate, saving you money immediately.

Unaffordable Monthly Payments

High rates and short terms can lead to enormous monthly payments that strain your budget. If you find yourself barely scraping by or needing to renew your loan repeatedly because the payment is too high, it’s a clear sign you need relief. By choosing to buy out title loans in Mesa, our customers often see their monthly payment drop significantly — making it feasible to actually pay off the loan instead of just treading water (example).

Balance Never Decreases

Are you making payments and feeling like you’re only paying the interest but the principal isn’t budging? You’re not imagining it. Many predatory title loans are structured so that you pay mostly interest upfront, meaning the loan balance stays high. Some borrowers even end up taking out one loan after another just to cover the old one, staying in debt for most of the year (source).

When we buy out title loans Mesa lenders have given at bad terms, we ensure your new loan is fully amortized – each payment will chip away at the principal so you can see progress.

Risk of Repossession

Falling behind on a title loan can put your vehicle at risk of repossession. In fact, about 1 in 5 title loan borrowers nationally have their car seized for failing to repay a single-payment title loan (source). Losing your car is devastating – it can mean losing your transportation to work or school.

Refinancing into a better loan can help you avoid this worst-case scenario by giving you a payment plan you can handle, before you get to the point of default.

Additional Cash in Hand

Believe it or not, a title loan buyout can sometimes get you more cash on top of paying off your old loan. If your vehicle has significant equity value that wasn’t fully leveraged by your previous lender, Phoenix Title Loans may be able to extend extra funds to you during the refinance — while still lowering your rate! It’s not guaranteed, but Mesa customers with valuable vehicles could potentially walk away with some additional money when they buy out title loans in Mesa drivers had elsewhere (source) — giving you extra breathing room when you need it most.

Peace of Mind

Perhaps the biggest reason to consider a buy out title loans in Mesa service is the relief it brings. You’ll no longer dread the loan due date each month. With a more affordable payment and a clear end-date to your loan, you can breathe easier. The stress of that old title loan will be gone, and you can focus on rebuilding your finances.

If all the above sounds familiar, it’s a strong sign that you should buy out title loans in Mesa has burdened you with and switch to a better plan. Refinancing can truly be a lifesaver for Mesa title loan borrowers.

How Does a Title Loan Buyout Work?

Thinking about buy out title loans in Mesa but unsure how it works?. The good news is that it’s straightforward and fast – we handle most of the legwork for you. Here’s how a title loan buyout works with Phoenix Title Loans in Mesa:

Contact Us / Visit a Mesa Location

Start by reaching out to Phoenix Title Loans. You can contact us by phone or online, or simply walk into one of our Mesa offices. We have three convenient Mesa locations (Central, East, and West Mesa) ready to assist. Let the loan officer know you want to buy out your title loan. They’ll guide you through the next steps and ensure you qualify (for example, your vehicle should have a clear title and your loan should not be in active default).

Bring Your Loan Information

To buy out title loans in Mesa borrowers have with another lender, we need some basic information on that existing loan. Typically, you’ll provide a recent statement or payoff quote from your current title loan. This document tells us how much is still owed (the payoff amount) and any relevant account details. Don’t worry if you’re not sure how to get this – we can help you obtain the payoff amount from your lender if needed.

Vehicle Evaluation

Just like when you got your original title loan, we’ll need to assess your vehicle’s value. Bring your car, truck, or motorcycle to the Mesa branch. We’ll do a quick inspection to confirm its condition and fair market value. This step ensures that the amount we lend you on the new loan (to pay off the old one) is still within the vehicle’s equity value. In many cases, the previous loan didn’t max out your equity, so this evaluation can also reveal if we can lend you a bit more cash in the refinance if desired (while still keeping payments affordable).

Loan Approval and Offer

Phoenix Title Loans will review your information and quickly come up with a refinance loan offer. We’ll tell you the new loan amount (which typically equals your old loan’s payoff, plus any extra cash you qualify for), the interest rate, monthly payment, and loan term. Our buy out title loans Mesa offers often feature interest rates far lower than what you were paying, and we structure the loan over a sensible term so that payments are manageable. There are no hidden fees or surprise charges – we lay out all the terms clearly in the contract (as required by Arizona law — see mytiorico.com).

Payoff of Your Old Loan

Once you agree to the new loan terms, we handle paying off your old title loan directly. Phoenix Title Loans will send the payoff amount to your previous lender on your behalf. You won’t have to juggle any complicated paperwork between lenders – we take care of transferring the title lien from the old company to us. Essentially, we buy the loan from your old lender, closing out that account. Now your only obligation is with Phoenix Title Loans under the new, improved loan terms.

Finish the Paperwork and Drive Away

We’ll have you sign the new loan agreement and any required documents (just like a standard title loan process). Once everything is signed, your title loan buyout is complete! Your previous loan is fully paid off, and your vehicle’s title is now held by Phoenix Title Loans as collateral for your new loan. You continue driving your car as normal throughout this process – there’s no interruption.

Depending on the situation, you might even receive additional cash in hand if we were able to extend a larger loan than your previous payoff. Most importantly, you now have a better loan: one with a lower rate, a manageable payment schedule, and no prepayment penalties if you decide to pay it off early (see details).

From start to finish, a buy out title loans in Mesa transaction can often be completed in as little as 30 minutes to an hour. Our team works efficiently because we know you need relief fast. Mesa customers appreciate that they can walk into a Phoenix Title Loans location with a problem loan and walk out the same day with a new loan that makes life much easier. When you let us buy out title loans Mesa on your behalf, you’ll likely wonder why you didn’t do it sooner – the relief is immediate and real.

Benefits of Buying Out Your Title Loan with Phoenix Title Loans

By now, it’s clear that refinancing can save you money – but why choose Phoenix Title Loans, LLC to buy out title loans Mesa drivers have? As a long-standing lender in Arizona, we offer distinct advantages that make us the go-to choice for title loan buyouts in Mesa. Here are some key benefits of working with us:

Significantly Lower Interest Rates

We pride ourselves on offering some of the most competitive interest rates in Mesa. Unlike many lenders who charge the state’s maximum rates, we strive to get you a far lower rate on your refinanced loan. Lower interest means you’ll save money every single month – and over the life of the loan – compared to your old deal. Our customers often cut their interest costs dramatically by using our buy out title loans in Mesa service (in some cases cutting the rate in half or better — see prestoautoloans.com).

Lower Monthly Payments

Because we reduce your interest and can extend the loan term to a reasonable length, your monthly payment will drop significantly once you buy out title loans in Mesa through us. We structure loans to fit your budget, not strain it. You’ll have a single, affordable payment each month that actually pays down your balance. No more juggling due dates or scraping by – refinancing makes your title loan payment truly manageable.

No Credit Checks Necessary

Worried that bad credit will stop you from improving your loan situation? With Phoenix Title Loans, it won’t. We do not require a traditional credit check for title loans (source), since your vehicle title is our collateral. Even if your credit score is low or you’ve hit bumps in the past, you can still qualify to buy out title loans Mesa lenders may have given you at high rates. We believe everyone deserves a chance at better terms.

No Prepayment Penalties or Hidden Fees

Our goal is to help you get out of debt faster, not trap you in a new one. We never charge prepayment penalties – you can pay off your new loan early at any time without any fees. In fact, we encourage you to pay it off as soon as you’re able, to save even more on interest. Also, our buy out title loans Mesa process itself has no buyout fee. We handle the loan transfer free of charge (source), so all your money goes toward paying off the loan, not miscellaneous fees.

Fast, Friendly Service

Time is of the essence when you’re trying to escape a bad loan. Our Mesa team moves quickly – as noted, we can often approve and fund a title loan buyout in 30 minutes or less. You won’t be sitting around for days waiting for an answer. Plus, our staff is experienced and understanding; we know you might be feeling stress or embarrassment about your situation. Rest assured, we’ve seen it all and we’re here to help, not judge. We’ll walk you through the process with a smile. Thanks to our streamlined system, buy out title loans Mesa requests are handled with top speed from start to finish.

Trusted Local Expertise

Phoenix Title Loans isn’t a fly-by-night operation. We’ve been serving the Valley (and Mesa in particular) for many years (source). We are fully licensed and comply with Arizona’s strict title lending laws, so you can be confident everything is above-board. Our reputation is built on helping customers succeed – which is why so many people in Mesa have trusted us to refinance their loans and why we’ve earned an A+ reputation. When you choose us to buy out title loans in Mesa residents have from other companies, you’re choosing a lender that truly has your best interests at heart.

Serving Mesa and Surrounding Communities

Phoenix Title Loans might have a robust location in Mesa, but our buy out title loans in Mesa services extend throughout the Phoenix metropolitan area and beyond. We understand that title loan troubles aren’t confined to one city. That’s why we proudly serve customers all across the Valley of the Sun. Whether you’re right here in Mesa or coming from a nearby community, we’re ready to help refinance your title loan.

In addition to Mesa, our title loan buyout and refinancing services are available to residents of Phoenix, Scottsdale, Gilbert, Tempe, Chandler, and Glendale. We also cover the West Valley cities like Buckeye (including the Verrado area), Avondale, Goodyear, Tolleson, Peoria, Sun City, and Surprise. Our reach even goes beyond the immediate Phoenix area – we’ve helped customers from places such as Cave Creek, Queen Creek, Anthem, New River, Maricopa, and Casa Grande with their title loans.

Essentially, if you’re in central or southern Arizona and need to buy out title loans Mesa or any other city has saddled you with, Phoenix Title Loans can likely assist. No matter where you come from, our goal is the same – to help you buy out title loans in Mesa borrowers want freedom from, and to do it with speed and compassion.

With multiple pawn shop partner locations and offices across the region (see locations), we make it convenient to get help wherever you are. (See our Pawn Shop Partner Locations page for a full list of locations and addresses.) Each branch upholds the same standards of fast, professional service. So even if you found us by searching for a Mesa-specific solution, know that the expertise of our buy out title loans in Mesa team is at your disposal no matter which location you visit.

We are one company, united in helping Arizonans regain control of their finances through sensible title loan refinancing.

Remember: buy out title loans Mesa, save money, and drive away happy! 🚗💸

DISCLOSURE: Loan amounts, terms, and rates vary by applicant and are subject to final approval. Not all applicants will qualify for the maximum advertised amount. All loans are secured by the value of your vehicle, which must be titled in Arizona and owned free and clear, unless otherwise stated.

Representative Example: A $2,000 auto title loan with a term of 12 months and an annual percentage rate (APR) of 35.99% would require 12 monthly payments of $200.96, for a total repayment of $2,411.52. All applicable fees and finance charges are included in the disclosed APR. This representative example is typical of a preferred loan with 25% Loan-to-Value ratio, $5,000 loan amount minimum, and a credit score of 700 or higher. Actual loan terms may vary based on vehicle value, requested loan amount, repayment ability, and applicable state regulations. CREDIT CHECK NOT REQUIRED ON MOST LOANS.

Early repayment is allowed at any time without penalty. Paying off your loan early may reduce the total cost of borrowing. Borrowers may be eligible for interest reductions when loans are paid off within an early payoff window, where applicable. We do not require a credit check for most auto title loans; however, all applicants must demonstrate the ability to repay the loan. Proof of income may be requested for underwriting purposes but is not always required for approval.

Approval times may vary and are subject to identity verification, vehicle inspection, confirmation of clear title status, and review of all required documents. While many loans are funded on the same day, some may require additional time for processing.

Phoenix Title Loans, LLC complies with all applicable federal and state lending regulations, including but not limited to the Arizona Revised Statutes Title 6, Chapter 5 and Title 44, Chapter 2.1, the Truth in Lending Act (TILA), and the Equal Credit Opportunity Act (ECOA). We are committed to transparency, fairness, and the responsible servicing of every loan. For borrowers who prefer to communicate in a language other than English, translated disclosures may be available upon request.