Everything You Need to Know About Pink Slip Car Loans

Table of Contents

For many people in Arizona, unexpected expenses can strike at any time. Whether you are in Phoenix, Mesa, Tempe, Scottsdale, Glendale, or surrounding areas like Buckeye, Avondale, and Peoria, finding fast access to cash is sometimes necessary. One option that many vehicle owners consider is pink slip loans. These loans allow you to use your vehicle’s title as collateral while still being able to drive your car. With the right lender, pink slip car loans can provide a flexible and fast solution when you need financial help without selling your vehicle outright.

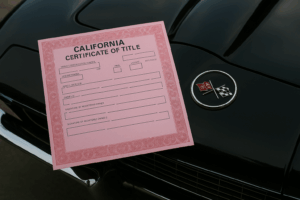

What Are Pink Slip Car Loans?

What Are Pink Slip Car Loans?

Pink slip car loans are a type of secured loan that uses your car’s title—sometimes called the “pink slip”—as collateral. When you take out this kind of loan, the lender places a lien on your vehicle until the loan is paid back. Unlike selling your car, you keep possession of it and continue driving. The amount you can borrow depends on the value of your car, its make, model, year, and overall condition. In Arizona cities such as Phoenix, Tempe, and Mesa, pink slip car loans are often popular because approval is typically much faster than with traditional bank loans.

How Do Pink Slip Car Loans Work?

The process of applying for pink slip loans is straightforward compared to many other loan types. Here’s a step-by-step breakdown:

- You present your vehicle’s title to the lender.

- The lender evaluates your car’s value, sometimes requiring a quick inspection.

- The loan amount is based on your car’s value and the lender’s policies.

- Once approved, you receive cash while the lender holds a lien on your vehicle’s title.

- You make scheduled payments until the loan is paid off, after which the lien is released.

In areas like Scottsdale, Glendale, or Casa Grande, loans are often preferred by people who need money quickly without waiting weeks for bank approvals. Unlike payday loans, which typically have short repayment terms, these loans can sometimes provide more flexibility depending on the lender’s structure.

Benefits of Pink Slip Car Loans

Benefits of Pink Slip Car Loans

There are several reasons why borrowers in Arizona turn to loans:

- Fast approval: Many lenders can approve and fund loans on the same day.

- Keep your car: Unlike selling your vehicle, you retain possession and use it daily.

- No perfect credit required: Since the loan is secured by your car, bad credit borrowers can still qualify.

- Accessible in multiple cities: From Phoenix to Surprise, Tempe to Sun City, residents across Maricopa County can benefit from these loans.

For borrowers who need a short-term solution to cover bills, medical expenses, or urgent repairs, pink slip car loans are often more accessible than traditional lending options. According to The Federal Trade Commission, secured loans like these are designed to give borrowers options when traditional loans aren’t available.

Risks to Consider

While pink slip car loans provide fast access to funds, borrowers should also consider the risks:

- Repossession risk: If you fail to repay the loan, the lender may repossess your vehicle.

- Higher interest rates: Compared to bank loans, pink slip car loans often carry higher rates.

- Short repayment terms: Some lenders require repayment within weeks or months, which can be challenging for certain borrowers.

Understanding both the benefits and drawbacks ensures that borrowers make the most informed decision when considering pink slip car loans. In Arizona, consumer protection laws require lenders to be transparent, so always read the loan agreement carefully.

Pink Slip Car Loans in Arizona

Pink Slip Car Loans in Arizona

Arizona residents across Phoenix, Tempe, Mesa, Chandler, Goodyear, and even towns like Anthem or New River often seek pink slip car loans as a way to handle emergency financial needs. At Phoenix Title Loans, we’ve served customers across Maricopa County and beyond, offering flexible and transparent loan options. Whether you live in Avondale, Queen Creek, Tolleson, or Buckeye, our team helps you leverage your vehicle’s equity for cash without leaving you stranded without transportation.

Why Choose Phoenix Title Loans

When it comes to car loans, choosing the right lender makes all the difference. At Phoenix Title Loans, we pride ourselves on transparency, customer service, and quick approvals. We don’t just serve Phoenix—we provide service across nearby cities such as Glendale, Scottsdale, Tempe, and Surprise. Our process is streamlined, and our staff explains every step, so there are no surprises. Plus, you can always call us directly at (480) 422-1826 to discuss your loan needs.

Alternatives to Pink Slip Car Loans

While pink slip car loans may be the right solution for some, it’s important to consider alternatives depending on your financial situation:

- Personal loans: If you have good credit, banks or credit unions may offer unsecured personal loans.

- Credit card advances: Though costly, some borrowers use credit cards for short-term needs.

- Borrowing from family or friends: This can sometimes be a lower-cost way to handle emergencies.

Still, for borrowers who need quick approval without credit barriers, pink slip loans remain one of the most practical options in Arizona.

FAQ About Pink Slip Car Loans

FAQ About Pink Slip Car Loans

Can I still drive my car with a pink slip loan?

Yes, you can. You keep possession of your vehicle while the lender holds the title as collateral.

Do pink slip car loans require good credit?

No, they are often available to borrowers with poor or no credit history.

What happens if I can’t pay?

If you fail to make payments, your lender may repossess the vehicle. That’s why it’s important to borrow responsibly.

Are pink slip car loans available near me?

Yes, whether you’re in Phoenix, Mesa, Tempe, Glendale, or nearby cities like Surprise, Casa Grande, and Maricopa, you can apply for these loans.

When used responsibly, pink slip car loans can be a helpful financial tool for Arizona residents who need fast access to funds. Always make sure to compare lenders, read agreements carefully, and borrow within your means.

DISCLOSURE: Loan amounts, terms, and rates vary by applicant and are subject to final approval. Not all applicants will qualify for the maximum advertised amount. All loans are secured by the value of your vehicle, which must be titled in Arizona and owned free and clear, unless otherwise stated.

Representative Example: A $2,000 auto title loan with a term of 12 months and an annual percentage rate (APR) of 35.99% would require 12 monthly payments of $200.96, for a total repayment of $2,411.52. All applicable fees and finance charges are included in the disclosed APR. This representative example is typical of a preferred loan with 25% Loan-to-Value ratio, $5,000 loan amount minimum, and a credit score of 700 or higher. Actual loan terms may vary based on vehicle value, requested loan amount, repayment ability, and applicable state regulations. CREDIT CHECK NOT REQUIRED ON MOST LOANS.

Early repayment is allowed at any time without penalty. Paying off your loan early may reduce the total cost of borrowing. Borrowers may be eligible for interest reductions when loans are paid off within an early payoff window, where applicable. We do not require a credit check for most auto title loans; however, all applicants must demonstrate the ability to repay the loan. Proof of income may be requested for underwriting purposes but is not always required for approval.

Approval times may vary and are subject to identity verification, vehicle inspection, confirmation of clear title status, and review of all required documents. While many loans are funded on the same day, some may require additional time for processing.

Phoenix Title Loans, LLC complies with all applicable federal and state lending regulations, including but not limited to the Arizona Revised Statutes Title 6, Chapter 5 and Title 44, Chapter 2.1, the Truth in Lending Act (TILA), and the Equal Credit Opportunity Act (ECOA). We are committed to transparency, fairness, and the responsible servicing of every loan. For borrowers who prefer to communicate in a language other than English, translated disclosures may be available upon request.