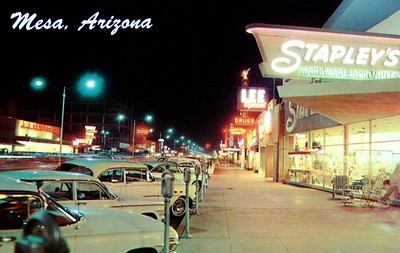

The History of Mesa in Arizona

Many people think that the history of Mesa started in 1877 when Daniel Webster Jones established a Mormon Settlement that eventually transformed into what we today call the City of Mesa, Arizona. However, this is not the case.

Many people think that the history of Mesa started in 1877 when Daniel Webster Jones established a Mormon Settlement that eventually transformed into what we today call the City of Mesa, Arizona. However, this is not the case.A City is Born & the History of Mesa Continues

After Daniel Webster Jones first settled in Mesa, AZ, additional settlements arose and created new canals using the preexisting ones from the Hohokam. The City of Mesa was first registered on the 17th of July, 1878 and was incorporated five years later with a pop. of 300 citizens.

After Daniel Webster Jones first settled in Mesa, AZ, additional settlements arose and created new canals using the preexisting ones from the Hohokam. The City of Mesa was first registered on the 17th of July, 1878 and was incorporated five years later with a pop. of 300 citizens.The Rapid Expansion

Two things that had a major effect the population on Mesa, were Falcon Field and the invention of the air conditioning. With when Falcon Field was brought into existence it drew many military people to Mesa. The air conditioning of course made Mesa a much more livable place.

Two things that had a major effect the population on Mesa, were Falcon Field and the invention of the air conditioning. With when Falcon Field was brought into existence it drew many military people to Mesa. The air conditioning of course made Mesa a much more livable place.DISCLOSURE: Loan amounts, terms, and rates vary by applicant and are subject to final approval. Not all applicants will qualify for the maximum advertised amount. All loans are secured by the value of your vehicle, which must be titled in Arizona and owned free and clear, unless otherwise stated.

Representative Example: A $2,000 auto title loan with a term of 12 months and an annual percentage rate (APR) of 35.99% would require 12 monthly payments of $200.96, for a total repayment of $2,411.52. All applicable fees and finance charges are included in the disclosed APR. This representative example is typical of a preferred loan with 25% Loan-to-Value ratio, $5,000 loan amount minimum, and a credit score of 700 or higher. Actual loan terms may vary based on vehicle value, requested loan amount, repayment ability, and applicable state regulations. CREDIT CHECK NOT REQUIRED ON MOST LOANS.

Early repayment is allowed at any time without penalty. Paying off your loan early may reduce the total cost of borrowing. Borrowers may be eligible for interest reductions when loans are paid off within an early payoff window, where applicable. We do not require a credit check for most auto title loans; however, all applicants must demonstrate the ability to repay the loan. Proof of income may be requested for underwriting purposes but is not always required for approval.

Approval times may vary and are subject to identity verification, vehicle inspection, confirmation of clear title status, and review of all required documents. While many loans are funded on the same day, some may require additional time for processing.

Phoenix Title Loans, LLC complies with all applicable federal and state lending regulations, including but not limited to the Arizona Revised Statutes Title 6, Chapter 5 and Title 44, Chapter 2.1, the Truth in Lending Act (TILA), and the Equal Credit Opportunity Act (ECOA). We are committed to transparency, fairness, and the responsible servicing of every loan. For borrowers who prefer to communicate in a language other than English, translated disclosures may be available upon request.