For Casa Grande Students

For those looking to seek a higher education, the one hurdle they must overcome is that of finances. It’s the test of one’s conviction to see if they are committed to reaching their higher education goals. Fortunately, Phoenix Title Loans can provide assistance for Casa Grande Students with our Student Auto Title Loans.

Are There Certain Vehicles That can be Used for These Title Loans?

Depending on the amount of money Casa Grande Students are able to use cars, trucks, vans, ATVs, scooters, and more. We’ve taken in Ford, Chevy, Kia, Subaru, and more. Once again, the only major requirements are the vehicle, its title, and your driver’s license.

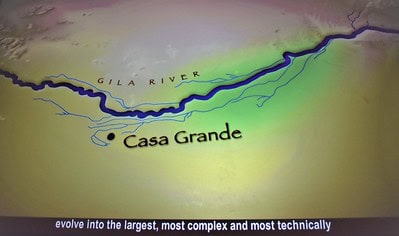

Where is Your Location in Casa Grande?

Where is Your Location in Casa Grande?

Whether you travel to Florence, Tempe or Tucson to go to school, or are seeking your degree online, it’s stressful to need cash. Thankfully, you can get the cash you need within less than an hour, when seeking a title loan. Because, Phoenix Title Loans, conveniently has a location right here in Casa Grande, and is open seven days a week. Just walk right in to Casino Pawn & Gold, and let our staff member assess your car and make a cash over today!

Click on the bottom right corner of your screen, and take advantage of our live-chat. Our assistant can answer any questions you may have, and can also begin the process online, prior to arriving at Casino Pawn & Gold.

Casa Grande Students Day-to-Day Living is Expensive

With the City of Casa Grande ever expanding, the cost of living continues to grow commensurately. As things continue to get more expensive, it becomes more taxing on their finances to peruse an education, even with the assistance from campuses such as Turning Point Beauty College, University of Arizona, Central Arizona College and more. Also, students want to enjoy life outside of college, but may lack the time or the funds to do so. Our Casa Grande Students Auto Title Loans give such an option by using their vehicles. Just bring your vehicles to us, along with your title and State-Issued Driver’s License.

With the City of Casa Grande ever expanding, the cost of living continues to grow commensurately. As things continue to get more expensive, it becomes more taxing on their finances to peruse an education, even with the assistance from campuses such as Turning Point Beauty College, University of Arizona, Central Arizona College and more. Also, students want to enjoy life outside of college, but may lack the time or the funds to do so. Our Casa Grande Students Auto Title Loans give such an option by using their vehicles. Just bring your vehicles to us, along with your title and State-Issued Driver’s License.

Getting through college is one of the most important experiences of your entire adult life, and it’s clearly not cheap whatsoever. While the sacrifice, we both know, will pay off at the end of the tunnel, getting there can feel incredulous due to mounting debt and minimized income. Phoenix Title Loans wants a future generation of college-aged individuals. and our auto title loans are one of the ways we’re trying to make that happen.

Why Trust in Phoenix Title Loans?

We’re a Valley owned and operated business, for starters. And while college students come in all walks of life, we understand the importance of having the money necessary to handle living in pursuit of an education. This understanding is what has allowed students to come to us when they needed it. It has been our standard for the past decade and continues to be this staple.

Phoenix Title Loans has been the leading title loan lender well over a decade. Pillars of the community trust us when it comes to securing the fast cash they need. What separates us from our competitors is our diligence to not ever have to turn customers away with at least some money in their pocket. Taking a brief look at our resources you’ll find in the menu up top it’s evident that we fulfill this commitment. We’re able to look past credit, income, living situation, title status, whatever! Phoenix Title Loans is here for Casa Grande Students, and be a financial resource you can rely on.

DISCLOSURE: Loan amounts, terms, and rates vary by applicant and are subject to final approval. Not all applicants will qualify for the maximum advertised amount. All loans are secured by the value of your vehicle, which must be titled in Arizona and owned free and clear, unless otherwise stated.

Representative Example: A $2,000 auto title loan with a term of 12 months and an annual percentage rate (APR) of 35.99% would require 12 monthly payments of $200.96, for a total repayment of $2,411.52. All applicable fees and finance charges are included in the disclosed APR. This representative example is typical of a preferred loan with 25% Loan-to-Value ratio, $5,000 loan amount minimum, and a credit score of 700 or higher. Actual loan terms may vary based on vehicle value, requested loan amount, repayment ability, and applicable state regulations.

Early repayment is allowed at any time without penalty. Paying off your loan early may reduce the total cost of borrowing. Borrowers may be eligible for interest reductions when loans are paid off within an early payoff window, where applicable. We do not require a credit check for most auto title loans; however, all applicants must demonstrate the ability to repay the loan. Proof of income may be requested for underwriting purposes but is not always required for approval.

Approval times may vary and are subject to identity verification, vehicle inspection, confirmation of clear title status, and review of all required documents. While many loans are funded on the same day, some may require additional time for processing.

Phoenix Title Loans, LLC complies with all applicable federal and state lending regulations, including but not limited to the Arizona Revised Statutes Title 6, Chapter 5 and Title 44, Chapter 2.1, the Truth in Lending Act (TILA), and the Equal Credit Opportunity Act (ECOA). We are committed to transparency, fairness, and the responsible servicing of every loan. For borrowers who prefer to communicate in a language other than English, translated disclosures may be available upon request.